Houses in Malaysia are getting more and more “expensive”. This has been re-litigated for years, especially in the past decade, as homeownership became more and more out of reach for the younger generation. High property price is often blamed upon “profit-seeking” developers who are in favor of building overpriced houses and eventually causing a high number of overhangs in the housing market.

While such an argument is prevalent, it is, in fact, biased and incomprehensive – in the sense that it overlooks an important cost factor that is incurred in housing development. Other than land cost and construction cost (including labour and building materials cost), the compliance cost (which is referred to as an expenditure derived from complying with set regulations) is also the main contributor to today’s high house prices.

What is compliance cost?

In common practice, compliance cost is levied on developers, in order to shift the responsibility of funding new growth-related infrastructure from the government to the developers. This cost can come in different forms, with the common one incurred from land conversion premiums and contribution charges paid to utility companies.

Part of these costs goes to the Improvement Service Fund (ISF) for purpose of the beautification, construction or laying out of any public infrastructure, open space or water-course; whereas the capital contributions go to utility providers (Tenaga Nasional Bhd, Telekom Bhd, Indah Water Konsortium Sdn Bhd and water authorities such as Syarikat Bekalan Air Selangor Sdn Bhd) for the provision of sewerage, telecommunication services, water and electricity in their projects. In either form, this cost will eventually be passed on to the free market house buyers, causing a relatively higher selling price.

How has compliance cost influenced property prices in Malaysia?

Looking back at house prices and development costs over the past 20 years, the growing wedge between these two illustrates that the cost of doing business has been trending upward over time, especially in those high-growth urban areas. The accumulation of regulatory barriers such as Bumiputera quota, mandatory building of price-controlled social housing, rigid planning requirements, one-size-fits-all housing standard – are all the main causes of growing development cost. As these artificial limits on housing development are increased or tightened, so does the cost and the time required to efficiently produce houses.

How expensive is building/construction cost in Malaysia?

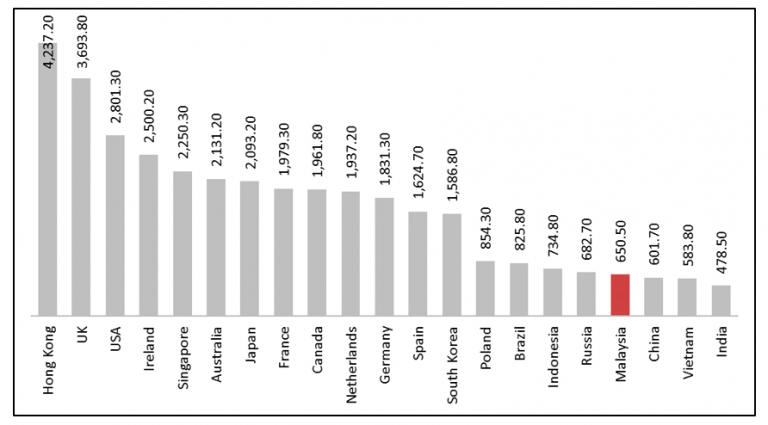

It is pretty low. Figure 1 shows the average per square meter of building cost for selected global economies. It is derived from six different building types: (i) medium standard terraced house, (ii) detached house, (iii) medium standard low-rise apartment, (iv) medium standard high-rise apartment, and (v) affordable unit. The average building cost per m2 recorded in Malaysia – USD650 – is on the lower end, which is much lower than Hong Kong (USD4,237), Singapore (USD2,250), Japan (USD2,093) and South Korea (USD1,586). Correspondingly, these countries do have a relatively higher house price compared to Malaysia.

When comparing the per meter square of average house price (USD/m2) among countries worldwide on NUMBEO, it is found that the house price (per m2) in Malaysia (USD1,668) is actually not as “expensive” as it is commonly perceived by locals. It is far behind most Asian countries like Hong Kong (USD23,977), Singapore (USD12,505), South Korea (USD8,311), Taiwan(USD6,149), China (USD5,205), and Thailand (USD2,689).

Even if Malaysia’s house price is compared with other developing Asian countries, which have a relatively lower GDP per capita like Vietnam, Iran, Philippines, Sri Lanka, Nepal, India, Iraq, and Indonesia; house price in Malaysia is still not “expensive”, considering the quality, standard, and the size of houses being offered. This justifies that Malaysia is pretty much relying on labour-intensive cast-in-situ construction methods to keep the building cost as well as house prices low.